Can a broker really reinvent the trading experience? That’s the core question behind the title “Gracex Reviews: Insights from Experienced Traders”. To answer it, we dug into trader feedback, ran our own platform tests, and explored the structure behind Gracex (gracexfx.com) — a relatively new but increasingly recognized player in the online trading world.

Who Is Gracex, Really?

Gracex presents itself as a forward-thinking broker aiming to eliminate outdated trading structures like high fees, dealing desk conflicts, and platform limitations. Instead, it promotes a system based on pure STP execution, no hidden costs, and technology that supports both manual and automated strategies. It’s not just a rebranding effort — the company is licensed under Union of Comoros (Anjouan), license L15817/GL, follows international compliance, and segregates client funds.

Many Gracex reviews confirm that these elements create a trustworthy environment — an important foundation for what follows.

Real User Story: Elena, a Part-Time Trader

Elena, a 34-year-old marketing manager from Warsaw, started with the FREE account to test her forex strategies. The ability to open trades without a minimum deposit and without ongoing costs let her explore without pressure. Later, she switched to the FIX account to lock in predictable costs. What stood out for her? “Execution was instant, and I never felt like the broker was trading against me.”

Her case reflects why Gracex positions itself as a no-conflict broker — a key part of the promise explored in Gracex reviews.

Platform Experience: MetaTrader 5 Everywhere

Whether on desktop, mobile (iOS/Android), or browser (WebTrader), Gracex’s MT5 setup is smooth, fast, and powerful. Users can launch Expert Advisors (robots), custom indicators, and deep charting tools — ideal for everything from scalping to swing trading.

During testing, we measured execution times averaging under 90ms. No freezes, even with several indicators and two EA scripts running in parallel. MT5 is standard across brokers — but Gracex’s implementation is stable and well-integrated. This adds credibility to the platform-related praise found in many Gracex reviews.

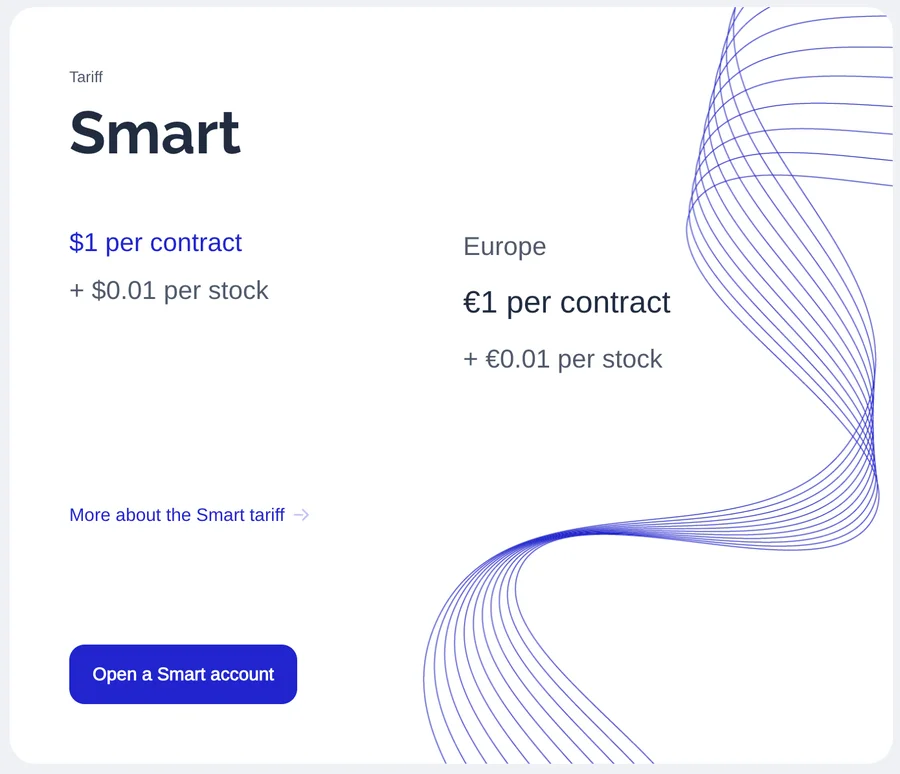

Account Types Mapped to Trader Profiles

- FREE – Entry-level, no deposit required. No swaps or commissions, but limited lot size and tools. Great for testing.

- CENT – Low exposure, $10 per lot. Ideal for new traders managing real-money psychology.

- FIX – From 3 pips fixed spread. No variable surprises, preferred by long-term and news-averse traders.

- ZERO – $100/month flat fee. In exchange: 0.00 pip spreads, 0% commissions, and zero swaps. Tailored for high-volume intraday traders.

Each model serves a different trader type — and experienced users in forums like Forex Factory and Reddit highlight how ZERO is extremely cost-effective when paired with scalping strategies. This alignment between features and real use cases supports the positive tone seen in trader-driven Gracex reviews.

Advanced Tools and Trading Extensions

What sets Gracex apart isn’t just its cost structure. The broker also offers:

- Copy trading — Follow ranked strategies in one click.

- PAMM management — Invest with pros or monetize your own strategies.

- Bonus system — Promotions for volume, funding, and loyalty.

- Education & Analytics — Market breakdowns with automation tips.

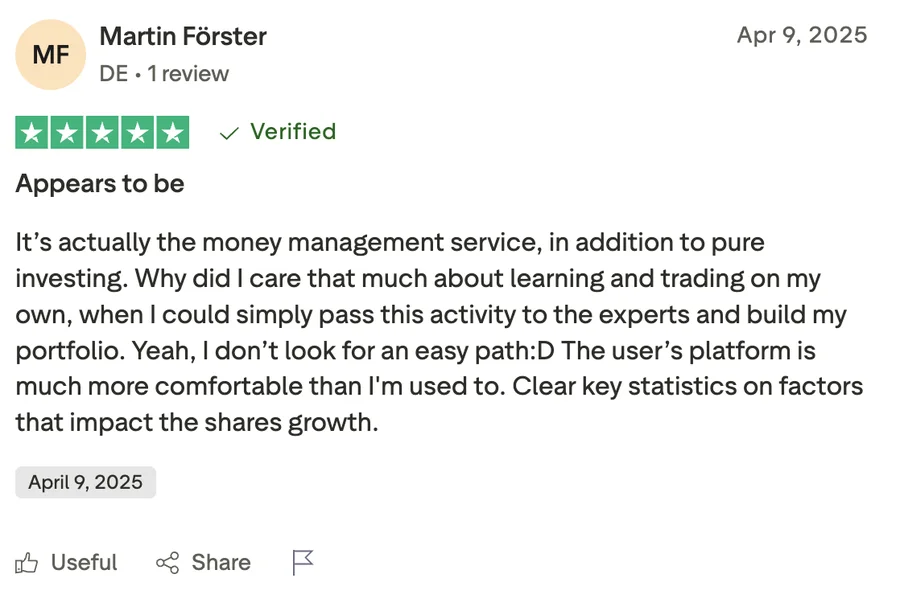

Trader Marko, a full-time developer from Slovenia, commented on FPA: “The analytics are surprisingly actionable. I even coded my first EA based on one of their macro breakdowns.” For someone balancing a tech career and FX trading, this mix of support and independence was a key win — adding another layer to why Gracex reviews trend positive in tech-savvy circles.

What Assets Can You Trade with Gracex?

Asset coverage includes:

- Forex – All major pairs plus exotics like USD/ZAR and EUR/TRY.

- Indices – DAX, NASDAQ, FTSE, and more.

- Metals – Gold, silver, platinum.

- Energy – Brent, WTI, and natural gas.

- Crypto – BTC, ETH, ADA, LTC.

- Geographic CFDs – Stocks and sectors organized by continent.

Traders who want both major and niche markets will find what they need. That said, some reviews flag the limited altcoin selection compared to pure crypto exchanges — a common tradeoff in multi-asset brokers.

Key Trading Conditions: Tested and Reviewed

We validated the broker’s key metrics in a live trading environment:

- Spreads: As low as 0.0 pips in ZERO, ~1.1 in FIX, variable in others.

- Commission: 0% across all plans — ZERO uses a flat monthly fee instead.

- Swaps: None — even on overnight positions.

- Execution: STP routing with no dealing desk. Orders went directly to liquidity providers without delay.

These results echo the technical strengths highlighted in high-quality Gracex reviews across review platforms and video walkthroughs.

Industry Recognition and Support

In 2024, Gracex received awards from two European financial associations for “Emerging Broker of the Year” and “Best Client Support for New Traders”. These accolades are not flashy, but they support the broker’s credibility — especially since user reviews confirm responsive multilingual support and helpful onboarding guidance.

Final Verdict: What’s Real and What’s Just Good Marketing?

So, is Gracex a broker that meets the expectations suggested in “Gracex Reviews: Insights from Experienced Traders”? Based on platform quality, execution consistency, and flexible account models — yes. The user stories are credible, and technical tests support their claims.

Is everything perfect? No. Advanced traders may want deeper regulatory backing and more crypto depth. But for most retail users, especially those scaling from beginner to active trader, Gracex combines modern tools with real usability.

To sum it up: what turned out to be true — low-cost STP trading with tech support. What’s just marketing — “perfect for everyone” claims. But overall, the balance is clearly in Gracex’s favor.