In an increasingly saturated trading industry, brokers often claim to offer the “best conditions” or “innovative services.” But what sets Gracex apart — really? This article examines whether that claim holds up, with a structured, fact-based overview of Gracex’s services, platform, legal setup, and reputation. Let’s explore the details behind the title.

Technology-Driven Trading with MetaTrader 5

Gracex anchors its offering on the MetaTrader 5 (MT5) platform, one of the industry’s most versatile tools. Available as a WebTrader, desktop client for PC, and mobile apps for Android and iOS, MT5 allows access from virtually any device — no installs required for browser trading.

The platform supports:

- Algorithmic trading via Expert Advisors (EAs)

- Custom technical indicators

- Depth-of-market tools

- One-click trading and integrated analytics

Gracex’s infrastructure connects to Tier-1 liquidity providers (including UBS, HSBC, Bank of China), allowing for tight spreads and minimal slippage. The broker’s execution speed reflects this setup, especially during high-volatility news events.

➡️ This level of tech access is a core part of what makes Gracex stand out — as promised in the title.

Trading Conditions: Real Cost Efficiency

Gracex adopts a pure STP (Straight-Through Processing) model, removing any internal dealing desk from the process. That translates to:

- Spreads from 0.00 pips

- 0% trade commission

- No overnight swaps

This setup is especially attractive to scalpers and high-frequency traders. Orders are processed directly through institutional-grade liquidity pools, without the broker acting as a counterparty. This model reduces conflict of interest and boosts trust.

➡️ Gracex’s conditions are not just marketing — they tangibly set the broker apart in everyday use.

Account Types That Match Trader Profiles

The platform offers four account types, each tailored to different styles and experience levels:

- FREE: No monthly fees; up to $500 deposit; for beginners testing the waters

- ZERO: $100/month flat fee; zero spread; best for scalpers and day traders

- FIX: Fixed spreads from 3 points; no hidden fees; ideal for automated trading

- CENT: Charges $10 per lot; designed for small-scale or low-risk strategies

Accounts can be upgraded or downgraded based on usage, making this system flexible and scalable.

➡️ This custom-fit approach reinforces Gracex’s unique value — a key factor in why it stands out.

Service Suite: Beyond the Basics

What truly sets Gracex apart is the variety of value-added services offered:

- Copy Trading: Auto-copy strategies from vetted professionals

- Social Trading: Observe community trends and sentiment

- PAMM Accounts: Invest in managed portfolios with transparent metrics

- Welcome bonuses for new users and ongoing promotions

- Educational tools and market analytics included in all account tiers

These services are particularly appealing to beginners and passive investors. Combined, they allow Gracex to compete not just on price or tech — but on convenience and guidance.

➡️ Service variety is a strong differentiator, making Gracex more than just a trading interface.

Asset Coverage: Wide and Global

Gracex supports a broad range of instruments, grouped across major asset classes:

- Forex: majors, minors, and exotic pairs

- Indices: global benchmarks like S&P 500, DAX, Nikkei

- Commodities: metals and energy (gold, oil, gas)

- Cryptocurrencies: BTC, ETH, SOL, and others

- CFDs on regional stocks from the US, Europe, Asia, and Russia

This mix allows users to diversify across volatility cycles and macro themes — all under one platform.

➡️ The asset diversity is practical, and contributes directly to what makes Gracex competitive.

Legal Framework: Compliance and Fund Security

Gracex is operated by GRACEXFX Ltd, licensed by the Union of Comoros (Anjouan) under license number L15817/GL. Key protections include:

- Segregated client funds — never mixed with operational capital

- Adherence to KYC and AML protocols

- Ongoing audits and external compliance reviews

While Anjouan is considered an offshore jurisdiction, the enforcement of segregation and disclosure rules builds foundational trust — especially when paired with positive user sentiment.

➡️ Gracex’s legal clarity gives added substance to its reputation for transparency.

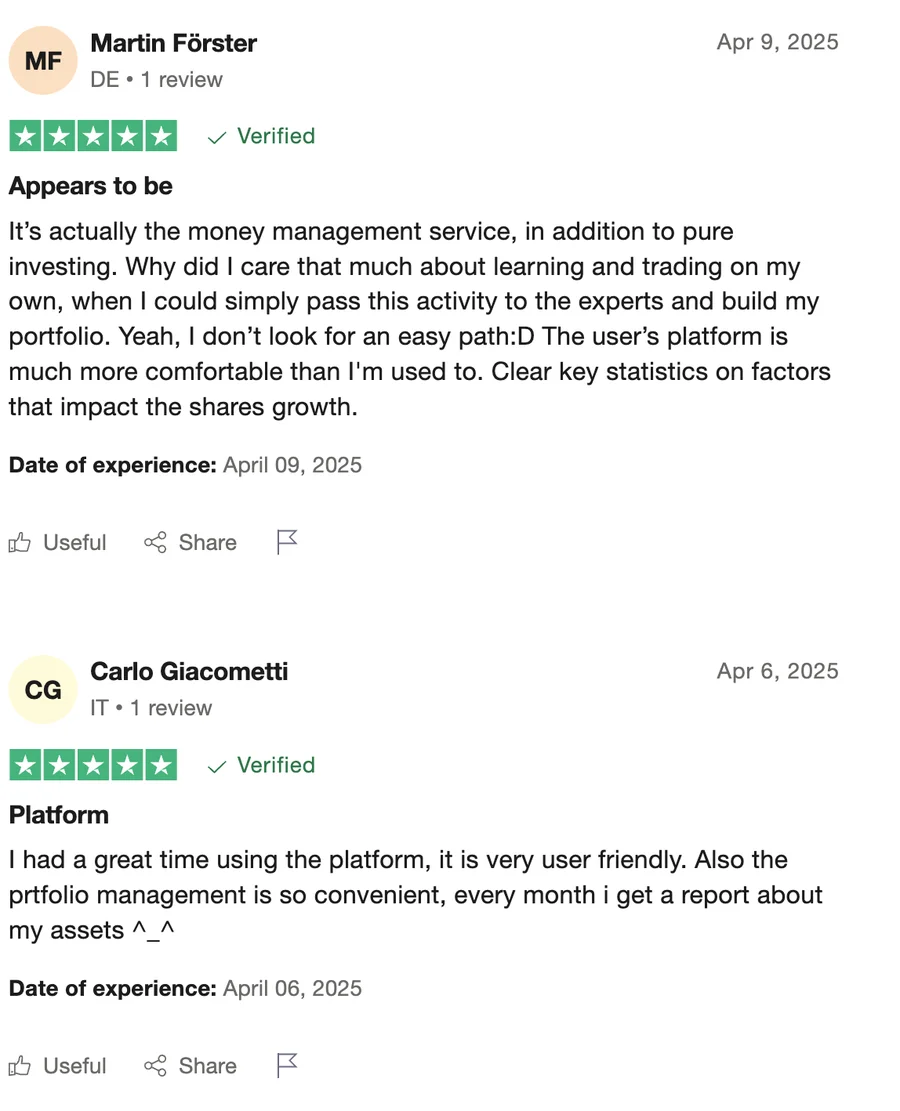

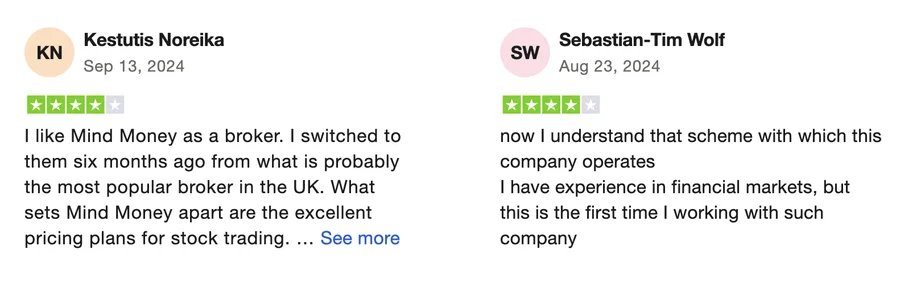

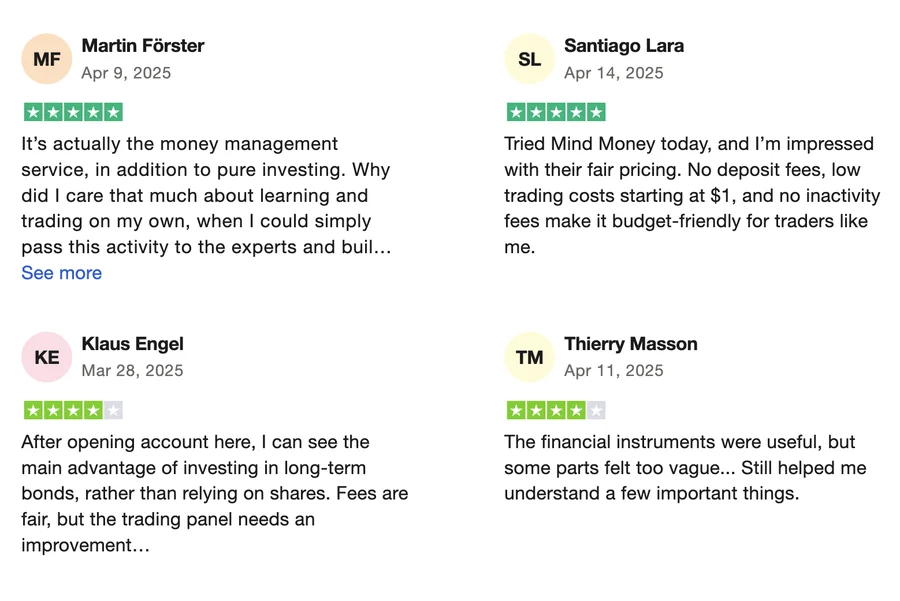

Recognition and Reviews: What Do Users Say?

Independent reviews from sources like Trustpilot, BrokerChooser, and trader forums provide a consistent picture. Strengths include:

- Cost efficiency — especially under ZERO accounts

- Execution reliability with near-zero slippage

- Beginner-friendly onboarding with helpful support

Criticism is limited but includes:

- Delayed live chat during peak hours

- No built-in stock trading (only CFDs)

In 2024, Gracex received industry recognition for its customer support and user growth — another indicator that the model is working.

➡️ The reviews validate what Gracex claims: it’s not just a brokerage, it’s a modernized experience.

Final Verdict — Does Gracex Truly Stand Out?

So, is it true that Gracex sets itself apart from the crowd? Yes — in most areas that matter to traders. From a clean STP model and cost-free trading to strong platform support and useful add-ons, the broker delivers more than just promises. It targets users who want transparency, automation, and control without excessive fees or limitations.

That said, users should still be aware of the offshore license and ensure it aligns with their jurisdictional requirements. But overall, what turned out true is the core value-for-money and functionality. What’s marketing fluff? Possibly the “revolutionary” branding — but the rest holds weight.

➡️ Gracex Reviews confirm that this broker has substance behind the story — and that’s what sets it apart.