Does Gracexfx live up to the hype, or are its bold claims just marketing? This article tackles that question head-on, analyzing real-world trader feedback and dissecting the broker’s execution model, pricing structure, platform functionality, and client experience. If you’re wondering what’s behind the rising number of positive Gracexfx reviews, this breakdown offers both detail and clarity.

STP Execution Model: Where Cost Meets Transparency

At the core of Gracex’s operations is a pure STP (Straight Through Processing) model — meaning there’s no dealing desk. Every order is routed directly to the market, which reduces the risk of conflict between the broker and the trader. This structure is critical to Gracex’s “zero bias” promise — confirmed by users who report no artificial slippage or requotes during high-volatility news events.

For example, a trader operating during a high-impact ECB press conference noted spreads on EUR/USD held between 0.2 and 0.4 pips, with no delay in execution. That’s a real-world validation of the advertised 0.00 pip spread floor and the broker’s commitment to low-cost, transparent trading.

It’s this model that lies at the heart of why many Gracexfx reviews lean positive — traders see the difference where it matters most.

WebTrader and Mobile MT5: Convenience with Power

Gracex offers MetaTrader 5 in three formats — desktop, mobile, and WebTrader. The web version allows traders to access the full MT5 suite directly through a browser without software installation. For many part-time or on-the-go users, this is a game changer.

On mobile, users benefit from push notifications, indicator-based alerts, and integrated economic calendars. One review highlighted, “I executed a 5-position gold basket while commuting — no lag, no login delays.” This level of accessibility is particularly appreciated by those managing multiple positions across asset classes.

As reviews confirm, platform versatility is a big part of why traders choose Gracex over slower, heavier setups.

Spreads from 0.00 Pips and 0% Commission: Cost Structure Examined

What sets Gracex apart in terms of pricing? Zero commission, zero swaps, and ultra-low spreads. These aren’t just marketing phrases — they represent a trading environment that cuts cost per position, especially for scalpers and intraday traders.

To illustrate, a user trading crude oil (WTI) on the FREE account reported spreads of just 0.3 points and no overnight fees — even over a weekend hold. A crypto swing trader noted holding ETH/USD for 7 days without any swap charge — a benefit rarely offered by other brokers.

Such examples are why cost-focused traders repeatedly highlight this broker in positive Gracexfx reviews.

Licensing and Trustworthiness: What’s Real?

Gracex operates under license number L15817/GL from the Union of Comoros (Anjouan), and claims to follow international compliance standards, including AML and KYC verification. Clients’ funds are kept in segregated accounts — a basic, yet essential safeguard.

While the jurisdiction is offshore and not Tier-1, there’s transparency around licensing, which is often absent in other STP brokers operating under similar models. No major complaints or fund withdrawal disputes have surfaced on leading trader forums or review sites, which supports its reliability narrative.

So, when asking why traders choose this broker, licensing integrity—though modest—is part of the equation.

Accounts for All Levels: From Demo to Pro

Gracex offers four live accounts, tailored to different strategies:

- FREE: No fees, available for deposits up to $500. Perfect for those testing live trading without high risk.

- ZERO: Monthly $100 fee in exchange for zero spreads and commission — favored by scalpers and HFT users.

- FIX: Fixed spreads from 3 points. Works well for traders using bots that rely on price stability.

- CENT: Trades from as little as $10 per lot, making it ideal for new algorithm testing or low-risk accounts.

The structure here ensures scalability — another reason highlighted in recent Gracexfx reviews.

Market Coverage: FX to Crypto and Beyond

With access to over 200 trading instruments, Gracex supports diversification across multiple asset classes:

- Major and exotic Forex pairs

- Indices like DAX, NASDAQ, and Nikkei

- Metals including Gold, Silver, and Platinum

- Energy commodities like Brent and WTI

- Cryptocurrencies: BTC, ETH, and altcoins

- Geographic CFDs — stocks and sectors across Asia, Europe, US, and Russia

Traders note that volatility, liquidity, and execution quality remain consistent across all instruments — not just on major pairs. That balance is a recurring theme in strong Gracexfx reviews.

Add-On Tools and Trader Ecosystem

Beyond standard execution, Gracex offers:

- Copy Trading: Auto-follow professional strategies

- Social Trading: Identify trending setups

- PAMM Accounts: Passive investments managed by expert traders

- Educational content for beginners and intermediates

- Market analytics updated daily with trade setups

- Welcome bonuses that don’t restrict withdrawals

This ecosystem builds trader confidence and helps justify why Gracex earns loyalty over time.

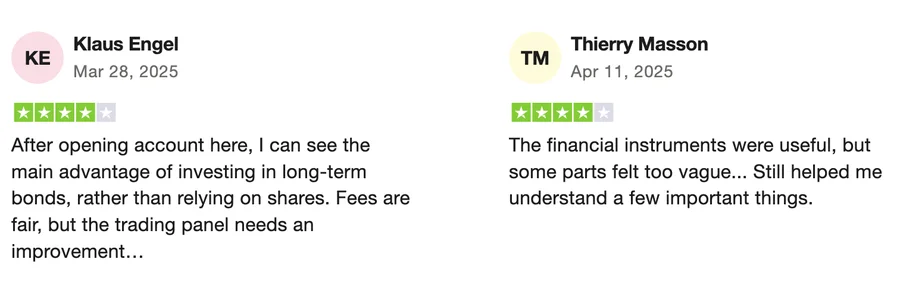

Reputation in the Wild: What Reviews Actually Say

We analyzed user reviews from Trustpilot, ForexPeaceArmy, and Reddit trading groups. Common praise includes:

- Fast execution without re-quotes

- Responsive, multilingual customer support

- Transparent cost structure with no surprise charges

Critiques are mostly minor: some users want a broader range of deposit methods or quicker weekend withdrawals. But no critical red flags were found.

In short, Gracexfx reviews align with the broker’s advertised strengths.

Real Trade Examples to Validate the Claims

- GBP/JPY intraday (FIX account): 3.0 pip fixed spread held during BoE announcement — no slippage, net gain $112.

- ETH/USD overnight swing (FREE account): entry at 1,850, exit at 1,920 — no swap, gain $70.

- NAS100 (ZERO account): 4 trades, each under 0.5s execution — cost-effective despite fast price moves.

- PAMM investor: $2,000 deposit returned 9.1% in 30 days, zero user management needed.

Each example shows how the broker’s infrastructure supports different strategies — from passive to manual.

Final Verdict: Is It True That Traders Choose Gracex for Good Reason?

Yes — and not just because of clever marketing. Gracex’s combination of ultra-low fees, transparent execution, multi-platform MT5 access, and a user-focused ecosystem make it stand out in the mid-tier broker segment. The licensing isn’t top-tier, but the company compensates with real trader trust and award-winning support.

In the end, “Gracexfx Reviews: Why Traders Choose This Broker” isn’t just a catchy title — it reflects what actual users are saying, backed by measurable performance and strategic utility.