Can a broker that promises zero spreads and 0% commissions actually deliver consistent quality? That’s the underlying question behind Gracex Reviews 2025. With rising popularity among retail and semi-professional traders, Gracex positions itself as a next-gen broker — but does it live up to the hype?

Gracex’s Vision: A Transparent, Tech-Centric Trading Model

Founded to challenge outdated brokerage models, Gracex focuses on transparency, automation, and low-cost trading. The company brands itself as a trader-first broker — offering services like copy trading, social feeds, and PAMM investment tools to bridge the gap between novice and experienced users. In Gracex Reviews 2025, this positioning is often cited as a major strength compared to “legacy” platforms that still rely on wider spreads and commission layers.

Ultimately, Gracex’s model is built around tech simplicity and strategic tools — a recurring theme in most Gracex Reviews 2025.

MetaTrader 5 Infrastructure: Flexible and Feature-Rich

Traders access the market via MetaTrader 5, supported through WebTrader, PC terminals, and mobile apps for Android/iOS. From multi-screen charting and integrated economic calendars to algorithmic trading and one-click execution, the MT5 environment is both scalable and powerful.

Backed by a pure STP model (Straight Through Processing), Gracex doesn’t interfere with trade flows — orders are routed to liquidity providers without manipulation. This setup offers low-latency execution and deep liquidity, especially on majors and popular indices.

This execution model is consistently praised in Gracex Reviews 2025, especially by users running EAs or engaging in news trading.

Account Types: Who Should Use What?

Gracex supports four account types, each tailored to different trader profiles:

- FREE: No minimum deposit, spreads from 1.5 pips, no monthly fee. Best for beginners and demo-to-live transitions.

- ZERO: $100/month subscription, spreads from 0.0 pips, no commission. Ideal for scalpers and high-frequency traders.

- FIX: Fixed spreads starting at 3 pips, suitable for traders who want stable costs regardless of market volatility.

- CENT: $10/lot cost, cent-based balances, perfect for testing or learning automated systems with minimal risk.

In practice, this account variety allows users to scale their strategy — something echoed in numerous Gracex Reviews 2025 focused on platform flexibility.

Costs and Conditions: 0.0 Pips, 0% Commission, Zero Swaps

Trading conditions are one of the most highlighted advantages in the 2025 reviews. For example, a trader using the ZERO account might pay less than $1 on a 1-lot EUR/USD trade, while the FIX account trader pays $30 for stability. The CENT account user testing an EA pays $10 per lot with minimal capital at risk.

Swap-free trading is another key highlight — overnight positions don’t incur rollover fees, which is a major plus for swing and position traders. Combined with raw spreads and fast order flow, Gracex presents a strong pricing model that undercuts traditional brokers relying on layered fees.

Real-World Example: On a 100k EUR/USD position:

- ZERO: ~$0 spread + $100 monthly (breaks even after 7–10 trades)

- FREE: ~1.5 pips = $15/trade

- FIX: 3 pips = $30/trade

- CENT: $10 fixed per lot

From the numbers, it’s clear why many traders call Gracex a “cost-cutting broker” in their reviews for 2025.

Trading Assets: Global Exposure Without Complexity

Gracex provides access to over 300 instruments including:

- Forex: all major pairs, exotics, and minors

- Indices: Dow, Nasdaq, DAX, Nikkei, etc.

- Metals & Energy: Gold, Silver, Oil, Gas

- Cryptocurrencies: BTC, ETH, ADA, XRP, and more

- Regional CFDs: exposure to European, American, Asian, and Russian stocks via baskets

This range allows strategic diversification — praised in Gracex Reviews 2025 especially by portfolio traders looking to hedge or rotate between markets.

Extras That Make a Difference: Copy, PAMM, Education

Gracex offers:

- Copy Trading: Mirror successful trades in real-time with transparency over performance metrics.

- Social Trading: Analyze community sentiment and trend-follow via a built-in feed.

- PAMM Accounts: Let professional managers handle your funds while you monitor performance.

- Bonuses: Welcome bonuses to extend capital for new users.

- Analytics & Education: Tiered learning with real examples, backtests, and platform walkthroughs.

These services remove friction in the learning curve and offer passive or semi-passive income paths — key factors driving user retention according to Gracex Reviews 2025.

Regulation and Legal Framework

Gracex is registered under GRACEXFX Ltd and licensed by the Union of Comoros (Anjouan), License No. L15817/GL. It adheres to international KYC/AML protocols and holds client funds in segregated accounts.

While this license is offshore, most traders in 2025 accept this as a tradeoff for lower costs and fewer bureaucratic barriers — as long as transparency and execution remain consistent, which Gracex seems to deliver.

This legal structure is often acknowledged in expert Gracex Reviews 2025 as “adequate for the target market” — particularly those looking for flexibility and affordability.

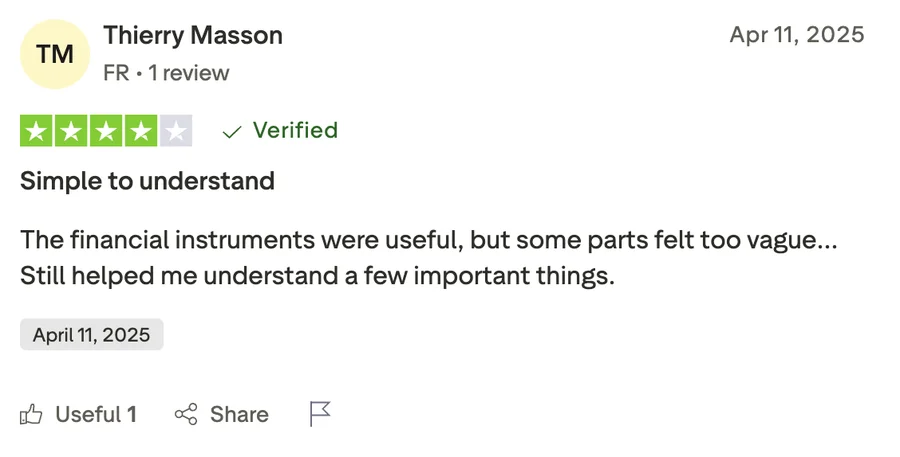

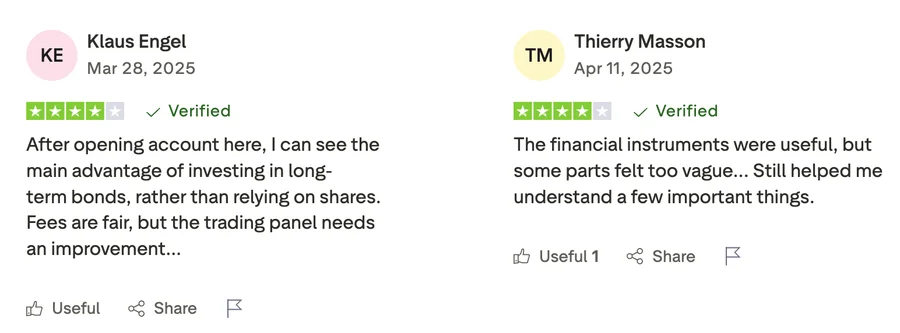

Reputation Breakdown: What’s the Buzz in 2025?

Sources: Trustpilot, ForexPeaceArmy, broker comparison portals, and Reddit trading subs.

Top strengths mentioned:

- Fast and stable execution on MT5

- Fair pricing — especially ZERO tier for scalping

- Easy registration and deposit process

- Helpful customer support with fast resolution times

Most frequent criticisms:

- No license in EU or top-tier jurisdictions

- Zero account only profitable with high trade volume

- Not available in some regulated markets (e.g., USA, Canada)

Overall, the sentiment in Gracex Reviews 2025 remains positive — especially when expectations are aligned with what the broker actually offers.

Final Verdict: Is Gracex Worth Trying in 2025?

Yes — for most retail traders, semi-pros, and strategy testers.

If you value low fees, automation support, fast execution, and flexibility in account choice, Gracex delivers. It’s not built for regulation-heavy environments but excels in providing cost-effective, practical access to global markets. Just pick the account type that fits your frequency and risk profile.

To conclude, Gracex Reviews 2025 show a broker that fulfills its core promises — with full transparency, smart features, and accessible trading conditions.

Your Next Steps (Based on Gracex Reviews 2025)

- Test the FREE account or open a demo to explore MT5 performance.

- Compare account types based on your strategy intensity and trading frequency.

- Join the copy or social trading network to gain insight and reduce manual load.

- Review Gracex’s fee structure vs. your current broker — especially if you’re trading actively.

- Read more Gracex Reviews 2025 from verified users to match real-world use cases to your goals.

Gracex isn’t perfect, but it’s purposeful — and in 2025, that counts.