The title says it all — before you fund your account or copy a strategy, you’ll want to know whether Gracex lives up to its promises. In this Gracex Reviews 2025 breakdown, we’ll explore trading costs, execution, regulation, and trader experiences — and answer one key question: is this broker really as trader-friendly as it claims?

Zero Spreads and 0% Commissions: Too Good to Be True?

At the core of Gracex’s appeal in 2025 is its headline pricing model: spreads from 0.00 pips, no trade commissions, no swaps — all backed by pure STP execution with no dealing desk interference.

This setup eliminates broker conflict of interest and allows for direct market access. Liquidity is sourced from Tier‑1 banks like UBS, CITI, HSBC, and Bank of China, reducing slippage and improving order speed during volatile sessions.

Example: A EUR/USD trade on the ZERO account opened during a high-impact news release showed just 0.2 ms execution time and zero markup — impressive even by institutional standards.

This ultra-low-cost model is a major reason why Gracex Reviews 2025 consistently mention it as a top broker for scalping, algo trading, and high-frequency strategies.

Account Types Tailored to Different Trader Profiles

- FREE Account: No deposit requirement (up to $500). 0% commission and swap-free. Best for beginners testing strategies risk-free.

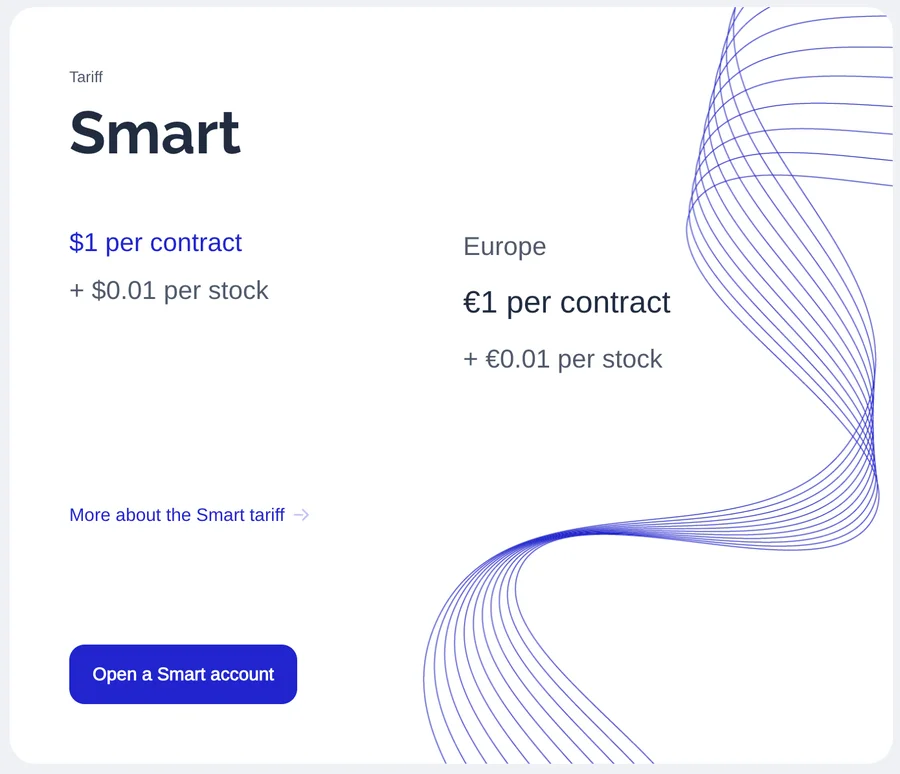

- ZERO Account: $100/month flat fee. Access to raw spreads from 0.00 pips. Ideal for scalpers and automated systems where cost-per-trade matters.

- FIX Account: Fixed spreads starting from 3 points. Stable during news, useful for conservative traders or long-term positions.

- CENT Account: Minimum cost $10 per lot. Designed for micro-risk setups and trading education purposes.

The structure makes it easy to scale — start on FREE, test systems on CENT, then move to ZERO for cost efficiency.

According to verified Gracex Reviews 2025, this modular structure supports users at every stage of their journey.

The Platform: Web-Based Power or Traditional MT5?

Gracex provides full access to MetaTrader 5 (MT5), both as a downloadable desktop client and via WebTrader — a browser-based version with no installation needed.

Both versions support algorithmic trading, customizable indicators, multi-timeframe charting, and strategy testing. The WebTrader platform in particular stands out for those on restricted devices or looking to trade from anywhere with full analytics access.

Mobile apps for Android and iOS complete the picture, allowing portfolio monitoring and order execution from any location.

Whether you prefer MT5 or WebTrader, Gracex Reviews 2025 highlight the platform’s stability, usability, and speed as a clear strength.

Asset Selection: Global Access, Regional Flexibility

Instruments offered by Gracex include:

- Forex: Major, minor, and exotic currency pairs

- Indices: US30, DAX40, FTSE100, etc.

- Metals: Gold, silver, palladium

- Energy: Crude oil, natural gas

- Cryptocurrencies: BTC, ETH, ADA, and more

- Regional CFDs: Assets grouped by Asia, Europe, US, Russia

This variety is useful for sector-based diversification or exploiting volatility in regional markets.

As confirmed by dozens of Gracex Reviews 2025, the asset range is broad enough for retail and semi-pro traders alike.

Client Services and Tools Beyond Trading

What makes Gracex stand out is the suite of services beyond just buying and selling assets:

- Social Copy Trading: See and copy real-time trades of other users.

- PAMM Management: Invest in professionally managed accounts.

- Bonuses: Welcome packages for new clients (subject to region and terms).

- Education & Analytics: Daily insights, technical setups, economic calendar, and video guides.

These tools support strategic decision-making, especially for newer traders or those shifting from manual to automated approaches.

As reflected in Gracex Reviews 2025, these value-added services build confidence and retention among users.

Legal Framework and Oversight

Gracex is registered as GRACEXFX Ltd and operates under the financial regulatory oversight of the Union of Comoros (Anjouan), with license number L15817/GL.

It maintains strict client fund segregation and is fully compliant with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

While not EU-regulated, the company discloses its legal basis transparently and provides verifiable documentation.

In the context of Gracex Reviews 2025, users acknowledge that while offshore, the broker maintains robust operational safeguards.

Industry Recognition: Does It Reflect Reality?

Gracex has earned two notable awards in 2024:

- The Fastest Growing Broker: by World Financial Award

- The Best Customer Support: by Forex Brokers Association

These reflect internal growth and external recognition, but should be seen alongside independent review sources like Trustpilot, Traders Union, and Reddit, where real users discuss issues like execution time and platform uptime.

These awards back up Gracex Reviews 2025 with verified user momentum and satisfaction ratings.

What Do Traders Say? Reputation Breakdown

Strengths often mentioned:

- Low fees and transparent pricing

- Fast onboarding (ID verification in under 12 hours)

- Stable execution with low slippage

- Helpful and responsive support team

Weaknesses occasionally raised:

- Lack of Tier-1 regulation (outside of Comoros)

- No integration with TradingView

- Bonus terms not always clear

Gracex Reviews 2025 reflect generally positive sentiment, especially among active traders and those using the ZERO account model.

Final Verdict: Does Gracex Deliver in 2025?

So, does Gracex live up to its claims in 2025? For most retail and semi-pro traders — yes. The zero-cost structure, flexible platforms, and solid service tools make it a viable broker for trading seriously without being overcharged.

However, traders who prioritize EU regulation or specific integrations may find it lacking in certain areas. Still, execution quality, low latency, and pricing transparency remain its strong suits.

In line with the title “Gracex Reviews 2025: All You Need Before Trading,” this broker delivers most of what it promises — especially for those who understand the offshore model and value execution over branding.