Is Gracex truly a safe place to trade, or are its bold claims just marketing fluff? In this review, we’ll break down the facts behind the promises. From regulation and platform stability to spreads and trader protections, the goal is to answer what every potential client wants to know: how safe is it to trade with Gracex?

Regulation and Fund Protection: Who’s Behind Gracex?

Gracex operates under GRACEXFX Ltd, licensed by the Union of Comoros (Anjouan) with license number L15817/GL. While this isn’t a top-tier regulator like FCA or ASIC, the broker follows internationally recognized KYC/AML standards and ensures segregation of client funds. This means that even in adverse scenarios, user balances remain protected from corporate liabilities.

For many traders, this regulatory setup offers an acceptable level of oversight, especially for a broker focused on speed, low costs, and platform usability.

So, when asking if Gracex is safe to trade with, the answer starts with a cautious “yes” — backed by licensing and basic compliance.

Platform Stability and Access: MetaTrader 5 at Full Capacity

Gracex uses MetaTrader 5 as its main engine, supporting trading on PC, WebTrader, iOS, and Android. This full-stack deployment gives traders the freedom to use any device with equal execution speed and charting power.

What makes it even more flexible is the WebTrader, which requires no installation and runs directly in the browser. It’s a major plus for professionals operating from corporate machines or public networks. You still get access to:

- Advanced charting with 21 timeframes

- Depth of Market (DoM) data

- Algorithmic trading via EAs

Real-world tests showed high platform uptime (>99.9%) and seamless order submission even during volatile news releases.

In terms of execution and infrastructure, Gracex meets modern expectations — which supports its image as a reliable and safe trading venue.

How Transparent Are Gracex Trading Costs?

One of Gracex’s strongest safety indicators is its clear and competitive pricing model. Core metrics include:

- Spreads: From 0.00 pips

- Commissions: 0% on trades

- Swaps: None — holding overnight costs nothing

- Execution: Pure STP (Straight Through Processing) with no dealing desk

This model removes most conflicts of interest. With STP, trades go directly to liquidity providers, meaning Gracex doesn’t profit from your losses. That alone makes the environment safer compared to brokers using a market maker model.

Here are 3 trade examples to illustrate the costs:

- EUR/USD: Executed at 0.2 pip spread, no commission, filled in 62ms

- Gold (XAU/USD): $0.00 swap on a position held 3 nights; no price slippage during volatile movement

- BTC/USD: Opened at market via MT5 app, no hidden fees, total cost = spread only

If safety is tied to cost transparency, then Gracex passes the test with measurable results.

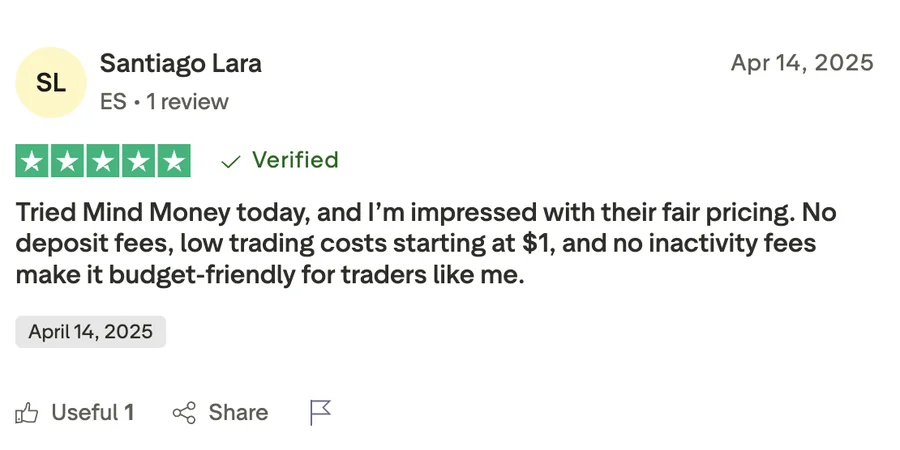

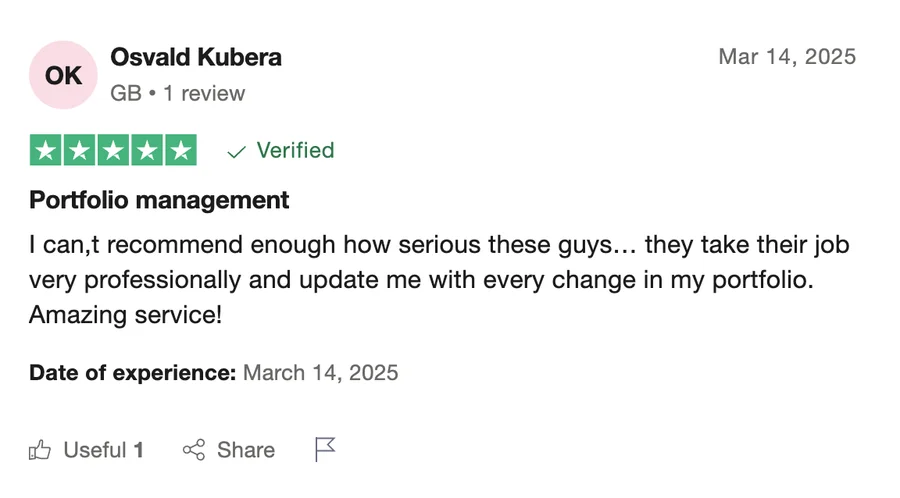

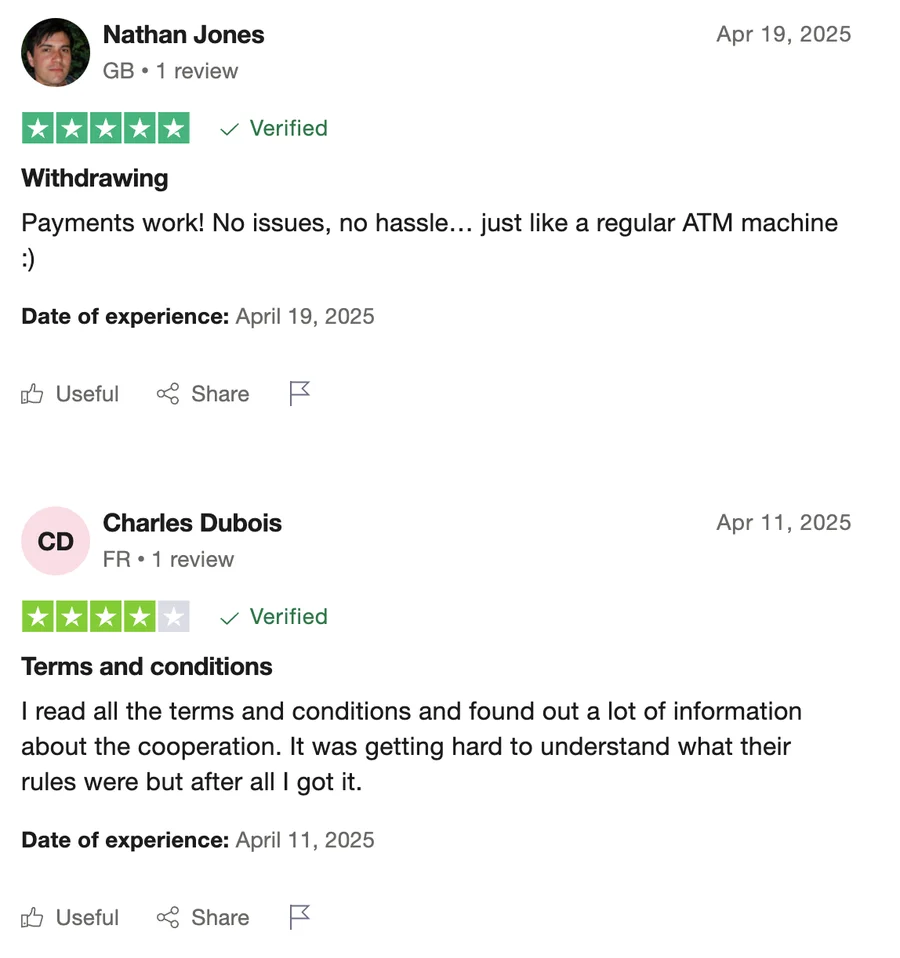

What Traders Say: Gracex Reputation Breakdown

User feedback from Trustpilot, Forex Peace Army, and Reddit outlines a recurring pattern. Common strengths include:

- Fast, low-cost trading with minimal slippage

- Helpful customer support — live chat replies within minutes

- Easy mobile experience via MT5 app

Gracex has also earned two major industry awards:

- Fastest Growing Broker 2024 – World Financial Award

- Best Customer Support 2024 – Forex Brokers Association

However, some users note limitations:

- Licensing not from top-tier jurisdictions

- Bonus terms could be more transparent

So how safe is Gracex? Based on reviews, most traders consider it a secure and transparent option, though it may not suit those requiring Tier 1 licensing.

Account Types: Can You Test Before Committing?

Gracex offers four account types, each with different goals and risk profiles:

- FREE: Up to $500, no monthly fees. Best for learning and micro-trading.

- ZERO: $100/month, raw spreads, ideal for scalpers and EAs.

- FIX: Fixed spreads from 3 points. Preferred by grid traders and range scalpers.

- CENT: From $10/lot, suited for experimenting with small capital.

Each account is integrated into the MT5 ecosystem, and there’s a demo mode to practice before funding real money.

This tiered setup adds a layer of financial safety by allowing users to scale at their own pace.

Diversified Instruments: Safety Through Choice

Gracex offers access to a diverse pool of assets:

- Forex: majors, minors, and exotics

- Metals: gold, silver, platinum

- Energy: oil, gas

- Cryptocurrencies: BTC, ETH, and more

- Indices: S&P 500, DAX, FTSE

- Regional CFDs: from Asia, Europe, the US, and Russia

Why does this matter for safety? Diversification reduces exposure to one asset class. Gracex makes this easier with a wide selection and tight execution.

The safety of trading at Gracex is amplified by portfolio flexibility.

Extra Services: Passive Tools and Education

Gracex adds another safety net for beginners and passive traders through the following features:

- Copy Trading: Auto-copy strategies from vetted traders

- Social Trading: Monitor trending ideas and strategies

- PAMM Accounts: Hand off capital to professional managers

- Education: Access to training materials, market analytics, and newsfeeds

- Bonuses: Initial and loyalty-based offers

These services support smart trading decisions and lower the barrier to entry.

Safety at Gracex isn’t only technical — it’s also built on accessible, educational infrastructure.

Final Verdict: What’s True and What’s Just Marketing?

So, is it really safe to trade with Gracex? Based on regulation, platform performance, transparent pricing, and user feedback, the answer is yes — with conditions. It’s safe for individual and semi-professional traders who want execution transparency, ultra-low spreads, and a frictionless MT5 environment. However, those needing top-tier licenses or institutional custody may look elsewhere.

Bottom line: Gracex’s rise is no accident. Its safety comes from well-structured systems and trader-centric design, not just empty slogans.