Is Gracex truly a tech-forward broker, or just another name in the crowded CFD space? That’s the question at the heart of most Gracexfx reviews. In this article, we dive into the numbers, evaluate execution conditions, explore account costs, and reflect user feedback to answer that question with clarity — not hype.

Company Profile: Gracex’s Vision and Oversight

Gracex is positioned as a new-generation broker, blending transparent pricing with technology-first solutions. Licensed by the Union of Comoros (Anjouan), under regulatory ID L15817/GL, the company adheres to international standards, including client fund segregation and KYC/AML compliance. Though not Tier-1 regulated, it is structured to meet most operational security demands for retail traders.

Its growth didn’t go unnoticed — in 2024, Gracex was named “Fastest Growing Broker” and awarded “Best Customer Support” by financial associations tracking broker performance in Europe and Asia.

From a governance and growth standpoint, this supports the claim behind the title: Gracexfx Reviews: Expert Analysis and User Feedback shows a broker worth a second look.

Trading Platform: MetaTrader 5 + Ecosystem

Gracex offers full access to MetaTrader 5 — the industry’s flagship platform. The broker supports MT5 via WebTrader, PC terminal, and mobile apps (iOS and Android), with full compatibility for Expert Advisors (EAs), technical indicators, and market scanners. Real-time analytics and customizable dashboards are available for all account tiers.

This combination enables advanced execution strategies without requiring specialist coding. Traders of all levels get speed, flexibility, and infrastructure — aligning with the tech-driven promise echoed in many Gracexfx reviews.

Pure STP Execution: Speed Without Interference

Gracex runs on a pure STP (Straight Through Processing) model — with no dealing desk. Orders are routed directly to external liquidity providers (such as UBS, HSBC, and Bank of China), meaning Gracex has no incentive to take the other side of your trade. This reduces slippage and boosts execution integrity, especially during volatile market periods.

In practice, this model has earned strong user sentiment, with traders praising fast fill rates even on news spikes — one of the consistent positives in expert and user-led Gracexfx reviews.

Markets Available: True Multi-Asset Access

Gracex provides access to over 500 trading instruments across:

- Forex: majors (EUR/USD, GBP/USD), minors, and exotics (TRY, ZAR, MXN)

- Indices: US30, GER40, FTSE100, and Asia-Pacific benchmarks

- Commodities: gold, silver, Brent, WTI

- Crypto: BTC, ETH, LTC, ADA, and more

- Regional CFDs: Stocks and ETFs from Europe, Russia, Asia, and LatAm

With this structure, the broker enables both diversification and niche plays — validating user interest reflected in top-tier Gracexfx reviews.

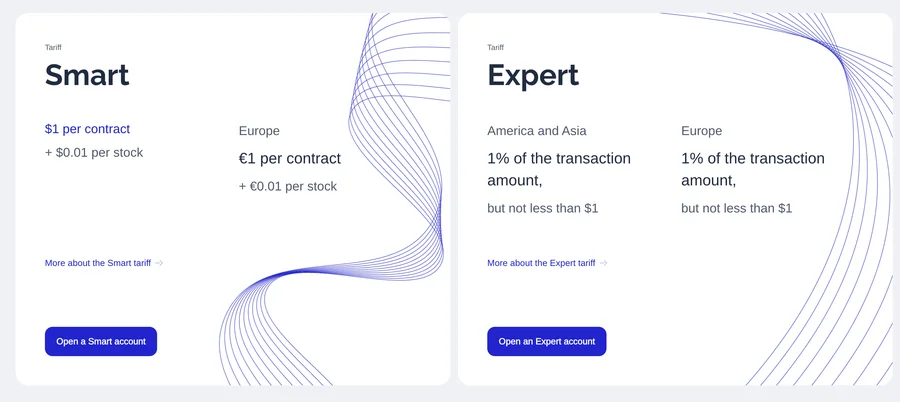

Account Types: A Cost Breakdown by Trader Profile

Gracex offers four distinct account options:

- FREE: No minimum; up to $500 cap; ideal for demo-to-live transitions. Spreads are wider but no fixed fee.

- ZERO: $100/month service fee; ultra-tight spreads (from 0.0 pips); zero commission or swaps. Good for high-frequency strategies.

- FIX: Fixed spreads from 3 pips; suited for traders who avoid slippage-sensitive instruments. No service fee.

- CENT: $10/lot cost model; excellent for micro lots, EA testing, or beginners learning live.

Example Cost: 1 Lot EUR/USD (100k Notional)

- ZERO: Spread 0.0 pips + $0 commission = $0

- FREE: Spread ~1.5 pips = $15

- FIX: 3 pips fixed = $30

- CENT: $10/lot flat

This makes the ZERO account most efficient for volume traders, while FIX suits those who need predictability over raw cost. User feedback supports this — most Gracexfx reviews praise this flexibility.

Trading Add-Ons: Copy, Social, PAMM & Learning

Gracex supports both passive and social engagement with:

- Copy Trading: Auto-copy trades from top performers.

- Social Trading: Follow sentiment-driven strategies.

- PAMM Accounts: Let professional managers trade for you.

- Bonuses: Occasional welcome and deposit incentives.

- Education: Webinars, strategy guides, indicator tutorials.

These features enrich the platform experience — and consistently boost satisfaction ratings in community-focused Gracexfx reviews.

Reputation and Feedback: What Users Are Saying

Sources: Trustpilot, ForexPeaceArmy, Reddit, broker comparison sites.

Common Strengths:

- Fast order execution and low slippage

- Low trading costs on ZERO and CENT accounts

- Responsive support with 24/5 availability

- Wide asset choice and solid MT5 performance

Frequent Weaknesses:

- Not regulated in Tier-1 jurisdictions (e.g., UK, EU, AUS)

- Some bonus conditions lack full transparency

- Account verification can take 1–2 business days

Overall, the sentiment aligns with our title: Gracexfx Reviews: Expert Analysis and User Feedback paints a picture of a competent broker with practical tools — albeit with offshore licensing limits.

Final Verdict: Is Gracex Worth Trying?

Yes — for traders seeking cost efficiency, platform reliability, and strategic flexibility. The ZERO and CENT accounts are particularly attractive for active or beginner profiles. If top-tier regulation is a requirement, then Gracex may not fully meet expectations. However, the broker compensates with execution transparency and support quality.

Checklist for New Traders (Based on This Review)

- Choose an account based on volume and cost profile

- Start with WebTrader or MT5 mobile for fast access

- Review PAMM/Copy options for passive trading

- Verify your account early to avoid delays

- Track spreads and execution speed in real time

As promised in the title — Gracexfx Reviews: Expert Analysis and User Feedback — the answer is clear: Gracex delivers on its core promises for most retail traders.